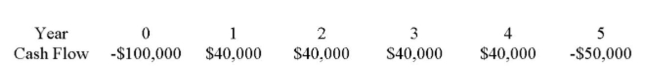

You are considering an investment with the following cash flows. Your required return is 10%, you require a payback of three years and a discounted payback of four years. If your objective is to

Maximize your wealth, should you take this investment?

Definitions:

Larger Hearts

This condition can be found in individuals with hypertension or athletes who engage in extensive endurance training, resulting in a heart that is larger than normal due to the increased workload.

ATP-CP Energy System

A short-term energy system that provides immediate energy through the breakdown of adenosine triphosphate and creatine phosphate in the muscles.

Glycolytic Energy System

A pathway for energy production that breaks down glucose for immediate energy, producing ATP anaerobically during high-intensity activities.

Glycolytic Energy System

A metabolic pathway that processes glucose for energy, significant during short-term, high-intensity exercises.

Q1: If Congress manages to agree on higher

Q1: Consider a company called MouseAway that produces

Q4: Some people argue that unemployment benefits (i.e.,

Q70: The Slim Waist announced today that they

Q228: You are considering a project that costs

Q231: Projects should be accepted when the profitability

Q274: Michael's Inc. 9% preferred stock is currently

Q283: Fora project with conventional cash flows, if

Q354: Explain why the internal rate of return

Q379: A project costs $475 and has cash