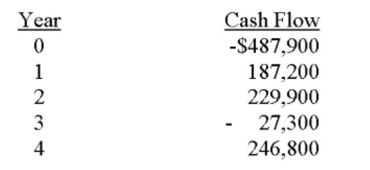

Bridgewater Fountains is considering expanding its current line of business and has developed the following expected cash flows for the project. Should this project be accepted based on the

Discounting approach to the modified internal rate of return if the discount rate is 9.6 percent? Why

Or why not?

Definitions:

Fixed Assets

Physical assets with a useful life greater than one year, which are used in the operations of a business, such as machinery or buildings.

Net Cash Flow

The difference between the cash inflows and cash outflows in a business over a specified period.

Depreciation Expense

A non-cash expense recorded on the income statement, reflecting the gradual reduction of an asset's value over its useful life.

Net Loss

When expenses total more than revenue, the result is net loss.

Q27: ABC stock closed yesterday at a price

Q111: Next year's annual dividend divided by the

Q154: Assume the anticipated growth rate in dividends

Q185: You are considering an investment which has

Q191: The _ decision rule is considered the

Q232: Suppose a project costs $300 and produces

Q256: Bliley Plumbers pays no dividend at the

Q332: If a company has a current stock

Q350: A firm has two classes of common

Q362: Shares of common stock of the Windy