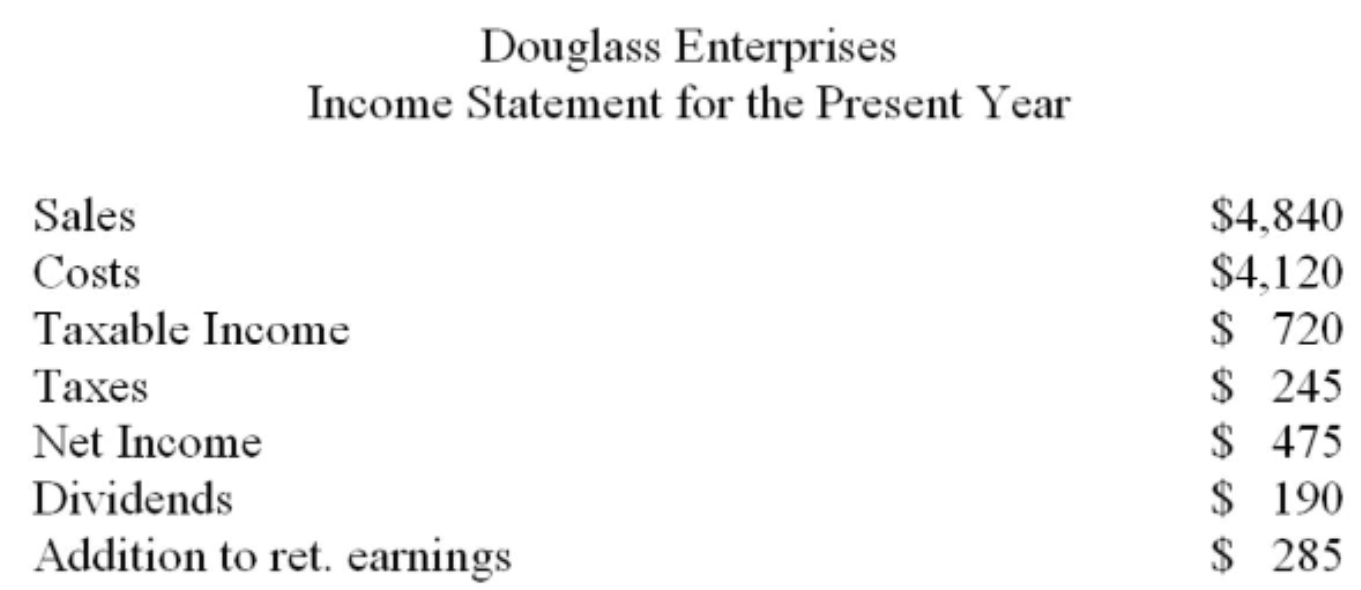

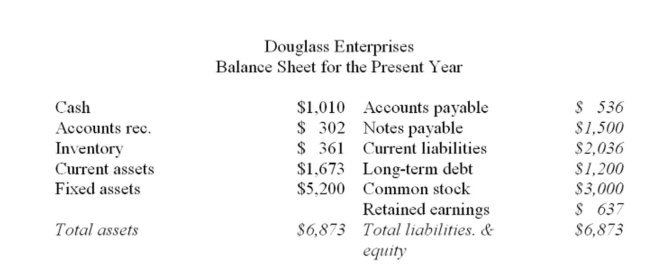

Assets, accounts payable and costs are proportional to sales. Debt and equity are not. The sales of Douglass Enterprises are expected to increase by 14% next year. The firm is currently

Assets, accounts payable and costs are proportional to sales. Debt and equity are not. The sales of Douglass Enterprises are expected to increase by 14% next year. The firm is currently

Producing at full capacity. Management wants to maintain a constant debt-equity ratio and a

Constant dividend payout ratio. What is the external financing need?

Definitions:

Component Costs

The expenditures involved in producing a product or service, segmented by parts such as labor, materials, or overhead.

Underlying Securities

Refers to the specific financial instruments (such as stocks, bonds, commodities, or currencies) that an option or other derivative contract is based upon.

Returns

The profit or loss generated from an investment, usually expressed as a percentage of the investment's initial cost.

Capital Structure

The composition of a company's funding through a mix of debt and equity securities.

Q3: Provide an appropriate definition of an annual

Q57: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2575/.jpg" alt=" Assets,

Q58: Provide a definition of discount rate.

Q106: Today, your grandmother gave you a gift

Q108: A Halifax firm generates net income of

Q113: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2575/.jpg" alt=" Assets,

Q319: Which of the following is correct concerning

Q363: Calculate the current ratio given the following

Q406: Calculate the return on equity given the

Q408: Jorge Corp. of North Bay has 100,000