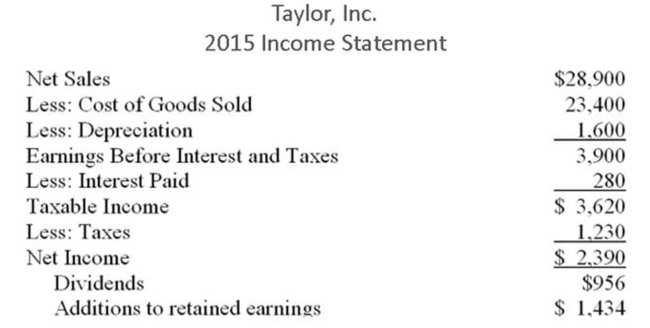

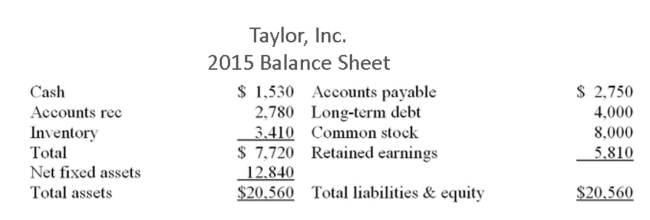

The following balance sheet and income statement should be used:

Assume that Taylor, Inc. is operating at full capacity. Also assume that all costs, net working capital, and fixed assets vary directly with sales. The debt-equity ratio and the dividend payout ratio are

Assume that Taylor, Inc. is operating at full capacity. Also assume that all costs, net working capital, and fixed assets vary directly with sales. The debt-equity ratio and the dividend payout ratio are

Constant. What is the projected increase in total assets if sales are projected to increase by 25%?

Definitions:

After-tax Real Interest Rate

The interest rate received by lenders or paid by borrowers, adjusted for inflation and taxes, that reflects the true cost of borrowing or real yield on savings.

Inflation Rate

The speed at which the overall price level of goods and services increases, diminishing the buying power progressively.

Deflation

A decrease in the general price level of goods and services, often indicating a contraction in the supply of money and credit in an economy.

Crop Prices

The selling price of agricultural products, which can fluctuate based on factors like supply, demand, weather conditions, and government policies.

Q13: Today Richard is investing $1,000 at 5%

Q64: You are considering two projects with the

Q84: When you retire 36 years from now,

Q153: The equity multiplier is a determinant of

Q172: Interest earned on both the initial principal

Q172: If total assets increase by the same

Q224: The interest rate used to calculate the

Q229: Percy's has a plowback ratio of 75%

Q277: An account paying annual compound interest was

Q377: When comparing the financial statements of one