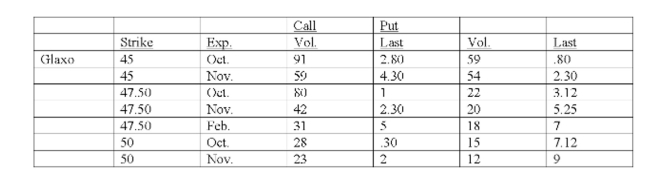

Underlying stock price: 45.80  Suppose you bought 10 Glaxo Oct 45 call contracts. Just before the option expires, the stock is selling for $50. What is your net profit (or loss) ? Ignore transaction costs.

Suppose you bought 10 Glaxo Oct 45 call contracts. Just before the option expires, the stock is selling for $50. What is your net profit (or loss) ? Ignore transaction costs.

Definitions:

Critical Thinking

The objective analysis and evaluation of an issue in order to form a judgment, characterized by open-mindedness and the ability to question assumptions.

Well-supported Reasons

Arguments or explanations that are backed by solid evidence, making them persuasive and credible.

Empirical Research

A way of gaining knowledge by means of direct and indirect observation or experience, often involving systematic data collection and experimentation.

Anecdotes

Short, often amusing or interesting stories about a real incident or person.

Q15: The buyer of a European call option

Q18: S&P 500 INDEX (CME); $500 times index

Q46: Mostly Right, Inc. has assets that are

Q59: The Enterprise Multiple is measured as:<br>A) Total

Q69: Striking price can best be defined as:<br>A)

Q73: Provide a definition of frame dependence.

Q101: What is the closing value on this

Q184: You currently own a one-year call option

Q339: Stock price Is a variables that is

Q397: The delta of a call option on