Multiple Choice

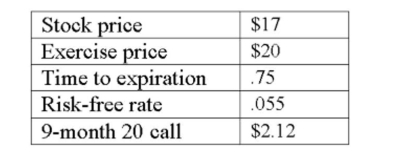

What is the value of a 9-month put with a strike price of $20 given the Black-Scholes Option Pricing Model and the following information?

Definitions:

Related Questions

Q3: Interest rate swaps are often used in

Q24: Explain the rationale behind the statement that

Q49: Which of the following is the best

Q66: When weighing a decision, Kate places greater

Q138: You purchased six TJH call option contracts

Q200: The Du Pont identity is defined as

Q289: Futures option contracts does not create a

Q299: Company A can borrow money at a

Q362: Relationships determined from a firm's financial information

Q394: You currently own a one-year call option