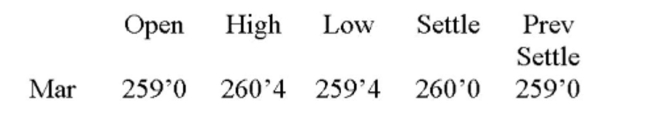

You are the purchasing agent for a cookie company. You anticipate that your firm will need 15,000 bushels of oats in March. You decide to hedge your position today and did so at the closing price of

The day. Assume that the actual market price turns out to be 261´0 on the day you actually buy the

Oats. How much more would you have spent or saved if you had not taken the hedge position?

Oats - 5,000 bu.: cents per bu.

Definitions:

Interviewer

An individual who asks questions in a structured or unstructured format to gather information, typically in a formal setting.

Types of Questions

Various categories or formats of questions used in different contexts, such as open-ended, closed-ended, leading, and rhetorical questions.

Testify

To give a formal statement of fact or evidence under oath in a court of law.

Credible

Being trustworthy or believable, especially in the context of sources of information or evidence.

Q18: S&P 500 INDEX (CME); $500 times index

Q76: Jennifer's Boutique has 2,100 shares outstanding at

Q95: Provide a suitable definition of risk profile.

Q120: Which one of the following statements is

Q197: The amount of the depreciation tax shield

Q222: Provide a suitable definition of futures contract.

Q239: Neither acquiring firm A nor target firm

Q246: Suppose you are interested in purchasing the

Q295: It is easier to hedge long-term financial

Q297: If a firm creates an interest rate