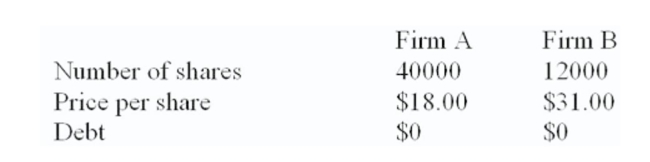

Firm B is willing to be acquired by firm A at a price of $34 a share in either cash or stock. The incremental value of the proposed acquisition is estimated at $80,000.  What is the true cost of the acquisition of firm B by firm A in an all-stock deal?

What is the true cost of the acquisition of firm B by firm A in an all-stock deal?

Definitions:

Discount Store

A retail store that sells products at prices lower than the typical market value, often by buying in bulk or selling overstock items.

Below Wholesale

Pricing that is lower than the standard wholesale price, often involving large quantities of goods being sold to retailers or other bulk buyers.

Markdown Timing

The strategic determination of when to reduce the selling price of goods, typically to clear outdated or excess inventory.

Valuable Selling Space

Locations or areas within a retail environment considered most effective for displaying products to attract customers and encourage purchases.

Q8: The buyer of an option contract:<br>A) Receives

Q19: The CRA requires that lease:<br>A) Terms stipulate

Q57: Provide a definition of a net advantage

Q76: Compare and contrast (A) forward contracts, (B)

Q78: You own a high-tech manufacturing entity. You

Q83: Firm A is being acquired by Firm

Q105: According to the CRA, for a lease

Q129: Westover Mills is trying to decide whether

Q185: What is the net advantage to leasing

Q248: What is the break-even lease payment?<br>A) $16,901<br>B)