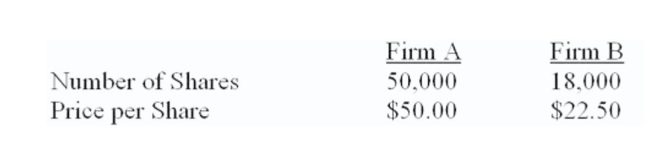

Suppose you have the following information concerning an acquiring firm (A) and a target firm (B) . Neither firm has any debt. The incremental value of the acquisition is estimated to be $250,000.

Firm B is willing to be acquired for $540,000 worth of Firm A's stock.  What is the price per share of the existing firm after the acquisition is completed?

What is the price per share of the existing firm after the acquisition is completed?

Definitions:

Reasonably Possible

A term used in accounting and law to indicate that a future event or condition has a chance of occurring.

Liability

A company's financial debt or obligations that arise during the course of its business operations.

Probable Loss

An estimated loss from a contingent liability that is likely to occur and can be reasonably estimated.

Reasonably Possible

Describes a level of likelihood that something might occur, under consideration in areas like assessments of contingent liabilities.

Q13: The Chicago Mercantile Exchange and the Chicago

Q26: Gateway Reproductions uses sheet steel to manufacture

Q92: Revenue enhancement represents a synergistic benefits from

Q98: Bridge Water Engineering needs to acquire $36,000

Q107: Both firms are 100% equity-financed. Firm A

Q109: Your company is considering the purchase of

Q158: If the costs of buying and selling

Q208: A financially sound firm can become financially

Q226: The value of an option if it

Q287: An interest rate swap is theoretically appealing