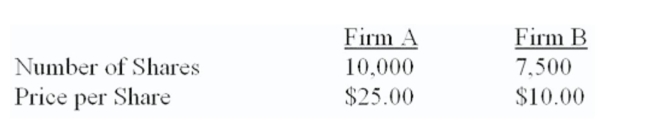

Both firms are 100% equity-financed. Firm A can acquire firm B for $82,500 in the form of either cash or stock. The synergy value of the deal is $12,500.  What will the price per share be of the post-merger firm if payment is made in stock?

What will the price per share be of the post-merger firm if payment is made in stock?

Definitions:

Profit Margin

A financial ratio indicating the percentage of revenue that exceeds the costs of goods sold, reflecting the efficiency of a company in generating profit.

Invested Assets

Resources such as securities and properties that an individual or company has allocated funds towards with the expectation of generating income or profit.

Minimum Return

Minimum return refers to the lowest acceptable profit or benefit that an investor expects to achieve from an investment, considering the associated risks and opportunity costs.

Gross Profit

The difference between sales revenue and the cost of goods sold, before deducting overheads, taxes, interest, and other expenses.

Q70: Explain the differences between an option contract

Q70: Jane's Footwear is planning on merging with

Q91: Firm A is being acquired by Firm

Q137: When a firm makes an acquisition to

Q178: Assume that 20% of the shareholders of

Q183: Suppose you have the following information concerning

Q198: Which of the following statements about warrants

Q239: Which of the following represents buying a

Q261: Webster's Tree Farm is considering the purchase

Q280: You think that market interest rates are