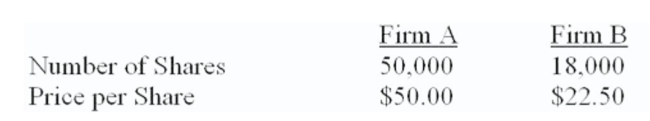

Suppose you have the following information concerning an acquiring firm (A) and a target firm (B) . Neither firm has any debt. The incremental value of the acquisition is estimated to be $250,000.

Firm B is willing to be acquired for $540,000 worth of Firm A's stock.  What are the synergistic benefits that arise from the acquisition of Firm B?

What are the synergistic benefits that arise from the acquisition of Firm B?

Definitions:

Sales Returns

Transactions in which customers return previously purchased merchandise to the seller for a refund, store credit, or exchange due to various reasons such as defects or dissatisfaction.

Income From Operations

The earnings of a business generated from its regular business operations, excluding revenues and expenses from non-operational activities.

Operating Expenses

Costs associated with the day-to-day functions of a business, excluding costs directly related to product manufacturing or service delivery.

Revenues

The total income earned by a company for selling its goods or services before any costs or expenses are deducted.

Q25: An operating lease can best be defined

Q36: Baker United owns several pieces of large

Q163: Provide a definition of a strategic alliance.

Q175: What is the difference between a spin-off

Q194: Boyer Services needs some equipment costing $56,000.

Q214: Which one of the following statements concerning

Q216: An acquisition of a firm through the

Q221: A longer-term, fully-amortized lease under which the

Q252: Which of the following is the best

Q273: Firm A is acquiring Firm B for