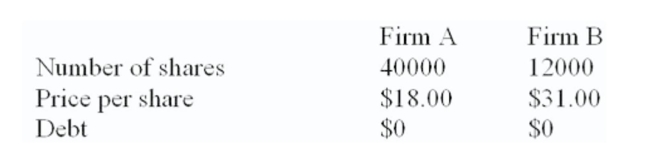

Firm B is willing to be acquired by firm A at a price of $34 a share in either cash or stock. The incremental value of the proposed acquisition is estimated at $80,000.  What is the value of firm B to firm A?

What is the value of firm B to firm A?

Definitions:

Oligopoly

A market structure characterized by a small number of firms controlling a significant portion of the market share, leading to limited competition and potentially collaborative behavior among firms.

Tacit Collusion

An agreement among competitors to act in a manner that increases profits without explicitly communicating or formalizing their actions as a pact.

Differentiated Products

Products that are similar but distinguished from each other by features, branding, quality, or other attributes.

Tacit Collusion

An unspoken arrangement between firms in a market to set prices or production levels that benefit them at the expense of market competition.

Q56: A forward contract is an agreement between

Q69: You purchased three July futures contracts on

Q101: Your firm needs to either buy or

Q105: According to the CRA, for a lease

Q105: You think that market interest rates are

Q120: A firm with a variable-rate loan can

Q129: Firm A is acquiring Firm B for

Q178: Which one of the following statements correctly

Q227: A targeted stock repurchase of the firm

Q307: All else equal, the cost of an