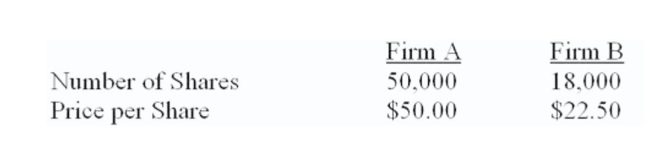

Suppose you have the following information concerning an acquiring firm (A) and a target firm (B) . Neither firm has any debt. The incremental value of the acquisition is estimated to be $250,000.

Firm B is willing to be acquired for $540,000 worth of Firm A's stock.  What is the price per share of the existing firm after the acquisition is completed?

What is the price per share of the existing firm after the acquisition is completed?

Definitions:

Short-Term Goals

Objectives set to be achieved in a brief period, guiding immediate actions and strategies.

Long-Term Goals

Objectives or targets that are planned to be achieved over an extended period, focusing on future aspirations and strategic outcomes.

Frequent Feedback

The process of giving regular, prompt responses or assessments regarding performance, behavior, or learning, aimed at improvement and development.

Goal-Setting Theory

A motivational theory that suggests setting specific and challenging goals, along with appropriate feedback, enhances performance.

Q24: The point where a lessee is indifferent

Q25: Which of the following is the best

Q68: Options that are frequently issued in conjunction

Q129: Westover Mills is trying to decide whether

Q146: A call can never be worth less

Q197: Provide a definition of diversification.

Q202: You purchased a May American put option

Q219: Which of the following is the best

Q246: Backwoods Furniture and Anderton's Furniture are all-equity

Q305: Alto and Solo are all-equity firms. Alto