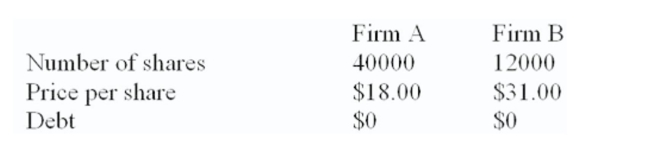

Firm B is willing to be acquired by firm A at a price of $34 a share in either cash or stock. The incremental value of the proposed acquisition is estimated at $80,000.  What is the amount of the merger premium per share if firm A acquires firm B in an all cash deal?

What is the amount of the merger premium per share if firm A acquires firm B in an all cash deal?

Definitions:

MR > MC

A situation in marginal analysis where the marginal revenue (MR) exceeds the marginal cost (MC), suggesting a potential increase in profitability by expanding production.

P > ATC

A scenario in which the price of a good is greater than the average total cost of producing that good, indicating potential profitability for the firm.

Short Run

A period in economic analysis where at least one input is fixed while others can be varied.

Monopolistically Competitive Market

A monopolistically competitive market is a type of market structure characterized by many firms selling products that are similar but not identical, allowing for product differentiation.

Q31: A financial device designed to make unfriendly

Q38: An advantage of a merger is that

Q100: An example of a(n) _ exposure would

Q196: A plot showing how the value of

Q200: The _ approach to capital budgeting analysis

Q222: Provide a definition of greenmail.

Q250: The chapter describes the "leasing paradox". What

Q266: Which one of the following statements concerning

Q274: Unused debt capacity refers to synergistic gains

Q314: Which of the following is the best