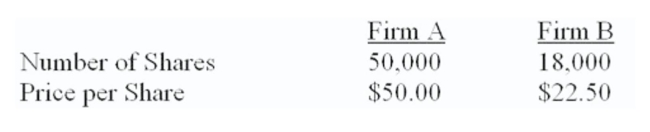

Suppose you have the following information concerning an acquiring firm (A) and a target firm (B) . Neither firm has any debt. The incremental value of the acquisition is estimated to be $250,000.

Firm B is willing to be acquired for $540,000 worth of Firm A's stock.  What is the merger premium per share in this case?

What is the merger premium per share in this case?

Definitions:

Fixed Costs

Costs that do not fluctuate with the level of production or sales, such as rent, salaries, and insurance premiums.

Break-Even Sales

The amount of revenue required to cover a company's total fixed and variable costs, without making a profit or loss.

Sales Revenue

The total amount of money generated from sales of goods or services, excluding any returns or allowances.

Mixed Costs

Costs with both variable and fixed characteristics, sometimes called semivariable or semifixed costs.

Q14: Which one of the following obligates the

Q37: Which one of the following is the

Q76: Draw a graph which depicts the value

Q106: You own a small gold mine in

Q122: Tuesday's and Thursday's are all-equity firms. Tuesday's

Q192: Ted purchased two October futures contracts on

Q205: Which of the following is the best

Q221: How much will you pay to purchase

Q235: Leasing likely works best when lessee firms

Q298: An option contract can be based on