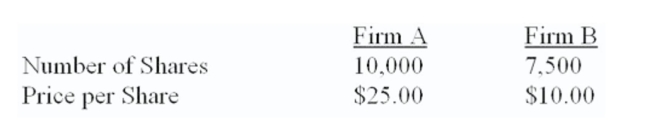

Both firms are 100% equity-financed. Firm A can acquire firm B for $82,500 in the form of either cash or stock. The synergy value of the deal is $12,500.  How many shares will be given to firm B's stockholders in the stock-financed deal?

How many shares will be given to firm B's stockholders in the stock-financed deal?

Definitions:

Government Purchases

Spending by the government on goods and services that are directly consumed or invested in by the government sector.

Short-Run Aggregate Supply

The total production of goods and services in an economy at different price levels in a short time frame, assuming that some production costs remain fixed.

Spending Multiplier

The ratio of a change in national income to a change in government spending that causes it, indicating the impact of fiscal policy on the economy.

Long Run

A period of time in economics where all factors of production and costs are variable, and all market adjustments have been made.

Q1: Suppose the distillation unit is actually worth

Q24: The point where a lessee is indifferent

Q47: Firm A can acquire firm B for

Q51: According to the relative purchasing power parity

Q57: Commodity prices, inflation, exchange rates and interest

Q60: A payoff profile helps:<br>A) Determine the price

Q61: Marschall's is trying to decide whether to

Q149: According to The National Post, the spot

Q155: An acquisition of a firm through the

Q246: Suppose you are interested in purchasing the