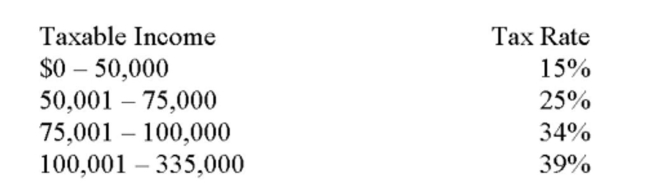

Given the tax rates below, what is the average tax rate for a firm with taxable income of $178,500?

Definitions:

Tax

A mandatory monetary fee or different kind of charge levied on a taxpayer by a government entity to support government expenditures and various public costs.

Tax Revenue

The income that is gained by governments through taxation, which is used to fund public services and government obligations.

Tax

A compulsory financial charge imposed by a government on individuals or entities to fund public expenditures, providing revenue for government functions.

Elasticities

Measures in economics that indicate how changes in one variable, such as price or income, affect a change in another variable, such as demand or supply.

Q7: Green Apple Fruit Farms has a four-day

Q8: If the lower limit on cash balances

Q122: Your chequebook shows you have a $10,000

Q124: Money market instruments:<br>A) Generally mature in 90

Q194: The credit period will typically be longer

Q233: Marc, a customer of The Blackstone Group,

Q261: Which of the following is the best

Q268: Which one of the following will increase

Q302: With respect to the workings of a

Q332: A Quebec resident earned $30,000 in capital