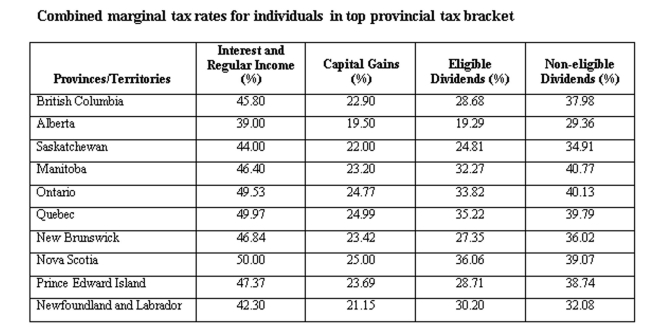

Calculate the tax difference between a British Columbia resident and an Ontario resident both having $20,000 in interest income and $25,000 in capital gains.

Definitions:

Private Ventures

Business projects or enterprises that are initiated and funded by private individuals or entities without governmental involvement.

Texas Movement

Refers to the series of events leading up to the secession of the Republic of Texas from Mexico and its eventual incorporation into the United States as a state.

Independence

The state wherein a nation, country, or state governs itself independently, possessing sovereignty and autonomy, uncontrolled by external forces.

Tejanos

People of Mexican heritage who have lived in the territory of the current state of Texas since before it became part of the United States, with a unique culture blending Mexican and Texan influences.

Q8: The earnings per share will:<br>A) Increase if

Q21: Which of the following is considered a

Q50: A board game sells for $29.99. Leo's

Q66: If provincial tax rates are 16% on

Q78: Your company purchased $10,000 worth of inventory

Q94: The cash flow to creditors for 2015

Q99: Newco, Inc. has gathered the following information

Q201: An impairment loss is defined as the

Q318: _ is a system for managing demand-dependent

Q352: On an average day, Cory, Inc. writes