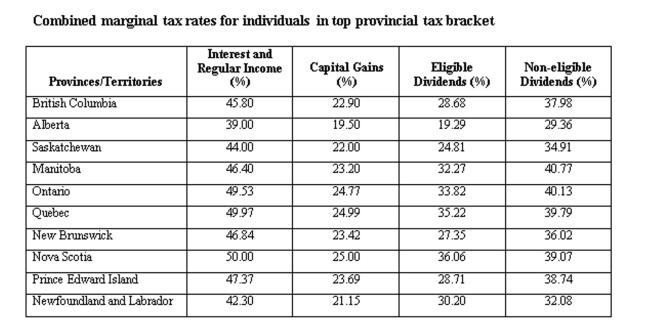

Calculate the tax difference between a British Columbia resident and an Alberta resident both having $20,000 in capital gains and $10,000 in eligible dividends.

Definitions:

Structural Brain Damage

It involves physical changes to the brain's structure due to injury, disease, or congenital conditions, potentially impacting cognitive functions and mental health.

Benzodiazepines

A class of psychoactive drugs used primarily for treating anxiety, insomnia, and several other conditions due to their sedative effects.

GABA

Gamma-Aminobutyric Acid, an inhibitory neurotransmitter in the brain that reduces neuronal excitability throughout the nervous system.

Derealization

Derealization is a dissociative symptom in which the external world feels unreal or distant, often experienced as a symptom of anxiety or other psychiatric conditions.

Q31: A firm sells 13,000 units a year.

Q39: Which of the following is the best

Q48: CBA, Inc., a leading retailer of consumer

Q144: On January 1, Slowpay Company makes a

Q166: A Prince Edward Island resident earned $20,000

Q207: A zero-balance account receives funds from a

Q255: Which one of the following will increase

Q265: The Gibson Co. generally receives 4 checks

Q363: A Saskatchewan resident earned $40,000 in interest

Q379: During the year, a firm paid $25,000