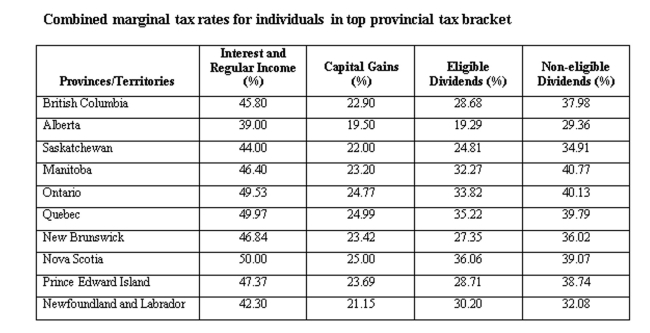

Calculate the tax difference between a British Columbia resident and a Quebec resident both having $20,000 in interest income and $25,000 in capital gains.

Definitions:

Federal Government

The national government of a federation that holds the authority over the political entities such as states or provinces.

Societal Institution

An established organizational structure or system in society that governs the behavior and expectations of its members.

Economy

The system by which goods and services are produced, distributed, and consumed in a society.

Production

The process of creating goods or services through the combination of labor, materials, and technology.

Q6: Establishing preauthorized payment arrangements will decrease the

Q56: Daycor Metals spends $68,000 a week to

Q57: A2/10, net 30 credit policy:<br>A) Is an

Q97: A firm sells 45,000 units a year.

Q98: Suppose that a firm paid dividends of

Q202: An Ontario resident earned $40,000 in interest

Q232: You are considering implementing a lockbox system

Q312: The procedures of the firm used to

Q366: Art's Boutique has sales of $640,000 and

Q376: What is net new borrowing for 2015?<br>A)