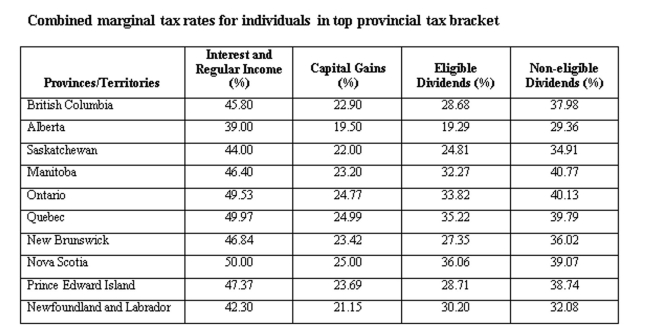

Calculate the tax difference between a British Columbia resident and an Alberta resident both having $20,000 in interest income and $25,000 in capital gains.

Definitions:

Short Term Profitability

The ability of a company to generate profit over a brief period, often evaluated on a quarterly or annual basis.

Marketing Costs

Expenses related to promoting and selling products or services, including advertising, product promotion, and sales force expenses.

Design Costs

The expenses associated with the conceptualization and development phases of product creation, including research, design, and prototyping.

Research and Development

The investigative activities a business conducts to improve existing products and procedures or to lead to the invention of new products and procedures.

Q23: Patents on new anti-cholesterol drug are considered

Q35: Custom Furniture provides handcrafted furniture made from

Q40: Which one of the following statements is

Q46: Dividends per share:<br>A) Increases as the net

Q135: An Ontarioresident earned $30,000 in capital gains

Q183: Which one of the following statements is

Q254: Donaldson, Inc. spends $79,000 a week to

Q266: According to generally accepted accounting principles (GAAP),

Q324: One of the primary products your firm

Q350: The BDF Co. receives five cheques per