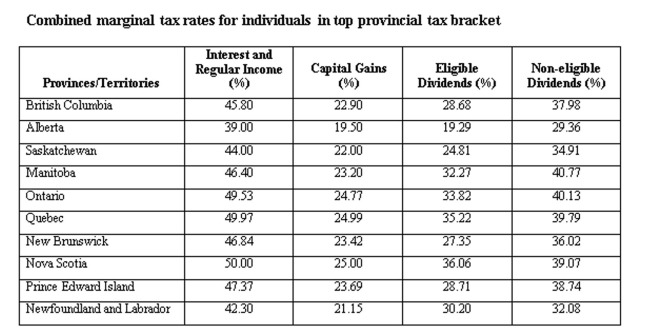

Calculate the tax difference between a British Columbia resident and an Ontario resident both having $20,000 in capital gains and $10,000 in eligible dividends.

Definitions:

Crisis Plans

Strategic preparations designed to respond effectively to emergencies or critical situations.

Alert System

A system designed to warn or inform people of potential or actual threats, emergencies, or important updates.

Emergency Procedures

Established protocols designed to guide responses to various emergency situations, aimed at minimizing harm and stabilizing conditions.

Small Group Counseling

A therapeutic approach where a counselor facilitates sessions with a limited number of participants, allowing for shared experiences and support.

Q1: Disbursement float is created every time you:<br>A)

Q47: Cash flow from assets is best described

Q80: A firm's marketable securities account has both

Q87: Which one of the following groups of

Q107: What is net new borrowing for 2015?<br>A)

Q141: Consider the case where a large firm

Q217: A Manitoba resident earned $40,000 in interest

Q230: You are considering switching from an all

Q302: With respect to the workings of a

Q405: Martha's Enterprises spent $2,400 to purchase equipment