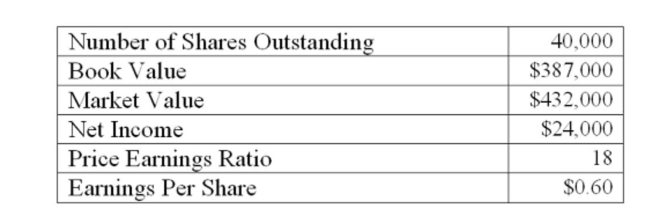

A Calgary firm is considering a new project which requires the purchase of $370,000 of new equipment. The net present value of the project is $67,000. The price-earnings ratio of the project

Equals that of the existing firm. What will the new market value per share be after the project is

Implemented given the following current information on the firm?

Definitions:

Q28: Jenna owns 600 shares of stock in

Q40: Ponderosa's bonds sell for $846.04. The coupon

Q67: The date on which existing shareholders are

Q100: Provide a definition for the term holder-of-record

Q216: The difference between the underwriters' buying price

Q217: M&M Proposition I with taxes states that

Q258: A Winnipeg firm is considering two separate

Q266: Turner Cement Products has a bond issue

Q285: The stock of Byron Enterprises is currently

Q328: Ignoring the risk level of a project