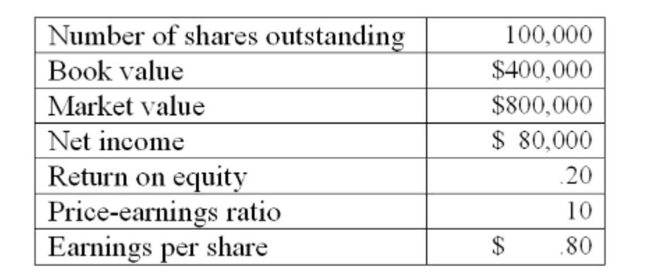

A Toronto firm is considering a new project which requires the purchase of $250,000 of new equipment. The net present value of the project is $100,000. The price-earnings ratio of the project

Equals that of the existing firm. What will the new market value per share be after the project is

Implemented given the following current information on the firm?

Definitions:

Stockholders' Equity

The portion of a company's assets that belongs to shareholders after deducting liabilities, representing ownership interest.

Common Stock

A type of security that signifies ownership in a corporation and represents a claim on part of the company's profits or losses.

Retained Earnings

The segment of net profit held back by the business rather than being shared with its proprietors in the form of dividends.

Deferred Revenue

Income that has been received by a company for goods or services not yet delivered or performed, recognized as a liability on the balance sheet.

Q129: The period after a new issue is

Q153: You are a secured creditor in a

Q180: Martha White's Fabrics is currently an all

Q193: Award: 2.00 points

Q252: The equity risk derived from a firm's

Q267: An issue of securities offered for sale

Q271: Watson's Automotive has a $400,000 bond issue

Q274: Blackstone, Inc. is currently an all equity

Q315: Lakeside Industrial has decided to sell an

Q317: Provide a definition for the term regular