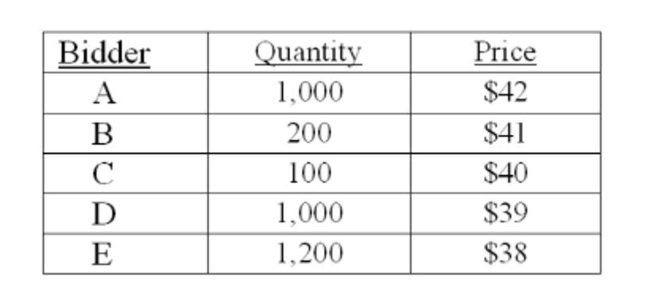

You decide to sell an additional 1,500 shares of stock in your firm through a Dutch auction. The bids that you receive include:  How much will you receive in total from selling the additional 1,500 shares? Ignore all transaction

How much will you receive in total from selling the additional 1,500 shares? Ignore all transaction

And flotation costs.

Definitions:

Lease Liability

An obligation representing future lease payments a lessee is required to make under a lease agreement.

Discount Rate

The discount rate applied in calculating the present value of future cash flows during discounted cash flow analysis.

Lessor's Income Recognition

The process by which lessors report income earned from leasing out assets, typically recognized over the lease term.

Operating Lease

A lease arrangement in which the lessee has the right to use an asset for a short portion of its useful life, and the lease does not meet the criteria to be recognized as a capital lease.

Q1: Given the following information, what is the

Q102: There are no taxes. EBIT is expected

Q113: A shareholder currently owns 500 shares of

Q220: Ina world without taxes, M&M Proposition I

Q232: A firm has a debt-equity ratio of

Q281: Uptown Appliances has an unlevered cost of

Q292: Nexum Inc. has a target debt-equity ratio

Q345: A firm has debt of $5,000, equity

Q347: McKean, Inc. has a debt-equity ratio of

Q364: Provide a definition of reorganization.