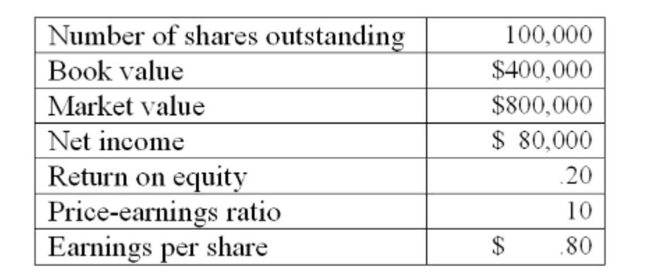

A Toronto firm is considering a new project which requires the purchase of $250,000 of new equipment. The net present value of the project is $100,000. The price-earnings ratio of the project

Equals that of the existing firm. What will the new market value per share be after the project is

Implemented given the following current information on the firm?

Definitions:

Q27: Underwriting where the syndicate sells as much

Q77: Individual investors who lend out part of

Q167: The SML approach generally relies on the

Q248: When a firm is operating with the

Q257: A general cash offer is an offering

Q282: The cost of debt is generally lower

Q308: Which of the following best defines the

Q321: The allocation percentage assigned to the number

Q339: Provide a definition for the term venture

Q375: Provide a definition of direct bankruptcy costs.