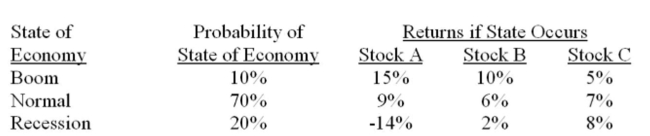

What is the standard deviation of a portfolio which is invested 20% in stock A, 30% in stock B and 50% in stock C?

Definitions:

Negative Signal

An indication or warning of potential problems, risks, or undesirable outcomes, often leading to a reassessment of strategies or decisions.

Bonus Pay

A plan that provides one-time payments based on performance accomplishments.

Lump-sum Payment

A one-time payment for the total amount owed, as opposed to payments divided into installments.

Performance Targets

Specific goals set by organizations or individuals aiming to achieve a defined level of performance over a given period.

Q15: What is the expected return for the

Q30: The risk premium for a firm is

Q116: Which of the following correctly completes this

Q116: The Capital Asset Pricing Model (CAPM) assumes

Q159: The subjective approach to project analysis:<br>A) Is

Q211: A stock returned 14%, -22%, 3%, and

Q213: According to theory, studying historical prices in

Q256: A stock had returns of 8%, 11%,

Q292: The rate of return on the common

Q361: The dividend growth model:<br>A) Generally produces the