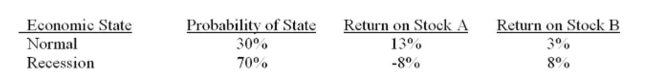

What is the standard deviation of a portfolio that is invested 60% in stock A and 40% in stock B, given the following information?

Definitions:

Coupon Rate

The interest rate that a bond issuer will pay to a bondholder, typically expressed as an annual percentage of the bond's face value.

Duration

A measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates, usually expressed in years.

Perpetuity

A financial term for a constant stream of identical cash flows with no end.

Yield

The earnings from an investment, like dividends or interest, shown as a percentage of the investment's original cost or its current market valuation.

Q43: Martha's Interiors has a beta of 1.2.

Q60: One year ago, you purchased a stock

Q63: Beta measures diversifiable risk.

Q79: Over the 1970-2005 period, the standard deviation

Q109: If a market has semi-strong efficiency, then

Q132: Theta stock returned 2%, -5%, 12%, and

Q171: A decrease in the amount of systematic

Q215: The Abco Co. maintains a debt-equity ratio

Q259: The reward-to-risk ratio can be defined as

Q341: The stock of Martin Industries has a