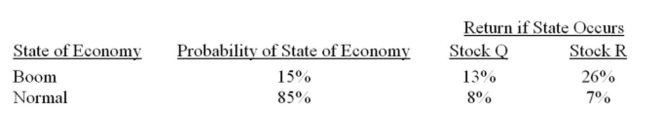

What is the standard deviation of a portfolio that is invested 30% in stock Q and 70% in stock R?

Definitions:

Social Learning Theory

A theory that posits individuals learn behaviors, skills, attitudes, and beliefs through observing and imitating the actions of others within social contexts.

Biofeedback Theory

A technique that teaches individuals to control bodily processes that are normally involuntary, like heart rate, using monitoring devices.

Unconditioned Stimulus

A stimulus that inherently and instinctively elicits a reaction without needing any learned behavior.

Conditioned Response

A learned response to a previously neutral stimulus that has become associated with an unconditioned stimulus.

Q63: Beta measures diversifiable risk.

Q132: Which one of the following statements is

Q134: In efficient markets, investments have an expected

Q177: Which one of the following statements concerning

Q185: Which of the following is correct regarding

Q189: Calculate the geometric return of an investment

Q283: Risk that affects a large number of

Q326: Top-Down, Inc. finances its operations using $1.50

Q344: What is the expected return on a

Q377: You recently purchased a stock that is