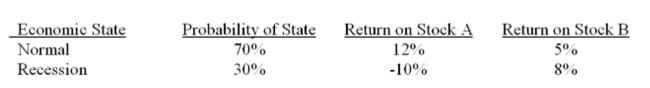

What is the expected return on a portfolio that is invested 40% in stock A and 60% in stock B, given the following information?

Definitions:

Total Asset Turnover

A financial ratio that measures a company's ability to generate sales from its assets by comparing net sales with average total assets.

Year 2

Typically refers to the second year of a particular time frame, such as a business plan, financial projections, or an academic calendar.

Total Asset Turnover

A financial ratio that measures a company's ability to generate sales from its assets, indicating operational efficiency.

Accounts Receivable Turnover

A financial ratio indicating how many times a company's accounts receivable are collected during a certain period, reflecting its efficiency in extending credit and collecting debts.

Q25: Production Unlimited has an overall beta of

Q49: Over the past five years a stock

Q122: West Minster Properties is considering a project

Q127: The normal distribution is useful in analyzing

Q186: A symmetric, bell-shaped statistical distribution that is

Q234: You purchased 300 shares of stock at

Q239: The relevant cost of debt for use

Q308: One year ago, Valerie purchased a stock

Q324: Over the last three years you earned

Q358: Which one of the following stocks will