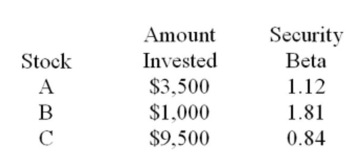

What is the beta of a portfolio comprised of the following securities?

Definitions:

Currency Swap

A financial agreement to exchange currency between two parties at a set rate, often used to hedge currency risk.

Interest Rate Swaps

A financial derivative contract between two parties to exchange interest rate payments on a specified principal amount, typically involving the swap of fixed for variable interest rates.

Variable Rate

A type of interest rate that changes over time, usually in connection with a specific index or benchmark rate.

Index

An index is a statistical measure or indicator that tracks the performance of a basket of assets, stocks, or other financial instruments, often used as a benchmark for investment performance.

Q39: The common stock of PDS has a

Q46: A security that has a rate of

Q52: Diversification works because unsystematic risk exists.

Q105: The intercept point of the security market

Q129: A stock had returns of 7%, 31%,

Q130: You just sold 450 shares of Zeus,

Q133: Ignoring taxes, if a firm issues debt

Q147: You purchase 100 shares of stock at

Q150: The long-term debt of Topstone Industries is

Q305: The weights that are commonly used when