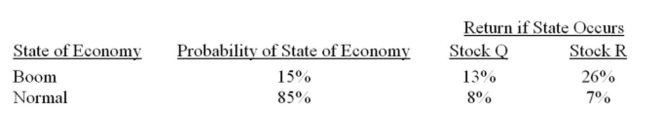

What is the standard deviation of a portfolio that is invested 30% in stock Q and 70% in stock R?

Definitions:

Differentiated Products

Goods or services that are distinguished from similar products in the market by unique characteristics, such as quality, brand, or performance.

Maximizing Profits

Refers to the process of increasing the difference between total revenues and total costs to achieve the highest possible earnings.

Minimizing Losses

A strategy or approaches taken to reduce the amount of loss incurred in a business operation or investment.

Price Discrimination

A pricing strategy where identical or largely similar goods or services are sold at different prices by the same provider in different markets or to different segments of consumers.

Q11: Which one of the following would tend

Q71: Your firm uses both preferred and common

Q91: Suppose a firm uses a constant WACC

Q108: The Capital Asset Pricing Model (CAPM) assumes

Q111: Which of the following is generally considered

Q127: The normal distribution is useful in analyzing

Q129: Given the following information: The risk-free rate

Q169: Provide a definition for systematic risk.

Q195: RMB, Inc. sold a 20-year bond at

Q266: If the returns on small-company stocks are