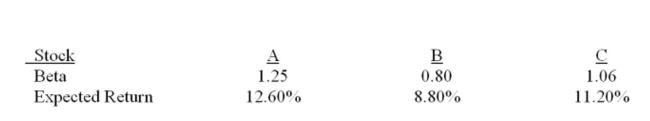

Which of the following stocks is (are) incorrectly priced if the risk-free rate is 4% and the market risk premium is 6%?

Definitions:

Correlation Coefficient

A statistical measure that indicates the extent to which two or more variables fluctuate together, ranging from -1 to 1.

Practicality

The degree to which something is realistic, feasible, or can be practically applied or implemented.

Format And Readability

Criteria evaluating how text is organized and presented for ease of reading and understanding.

Content Validity

A measure of how well test items represent the domain they're intended to assess, ensuring the test is comprehensive and relevant.

Q9: The risk premium increases as the non-diversifiable

Q22: Assume the return on T-bills is normally

Q33: The higher the standard deviation, the less

Q51: Provide a definition for cost of debt.

Q54: Over the period of 1970-2005, small-company stocks:<br>A)

Q132: Which one of the following statements is

Q258: The inclusion of thirty highly diverse securities

Q282: Diversification works because firm-specific risk can be

Q284: You own the following portfolio of stocks.

Q355: Using the Capital Asset Pricing Model (CAPM),