Magellen Industries is analyzing a new project. The data they have gathered to date is as follows:  Initial requirement for equipment: $120,000 Depreciation: Straight-line to zero over the four-year life of the project with no salvage value.

Initial requirement for equipment: $120,000 Depreciation: Straight-line to zero over the four-year life of the project with no salvage value.

Required rate of return: 15%

Marginal tax rate: 35%

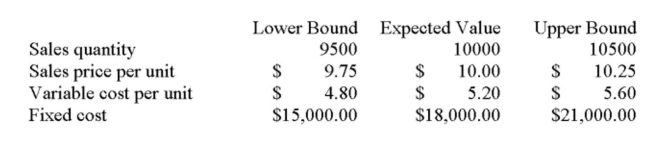

What is the net income under the worst-case scenario?

Definitions:

Q10: A project with IRR = -100% is

Q30: The Quick Producers Co. is analyzing a

Q53: The recovery of the money spent for

Q57: You want to determine how changes in

Q106: Provide a definition for the term operating

Q154: Which of the following does NOT require

Q167: The possibility that errors in projected cash

Q231: The average squared difference between the actual

Q325: The notion that actual capital markets, such

Q341: A firm that cannot obtain funds to