A project requires an initial investment of $10,000, straight-line depreciable to zero over four years. The discount rate is 10%. Your tax bracket is 34% and you receive a tax credit for negative earnings

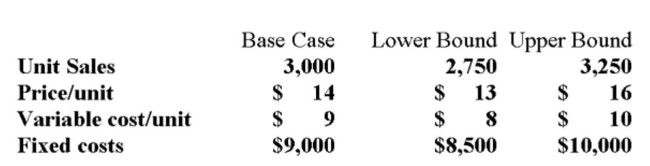

In the year in which the loss occurs. Additional information for variables with forecast error are

Shown below.  What is the worst case NPV for the project?

What is the worst case NPV for the project?

Definitions:

Genital Human Papillomavirus

A common sexually transmitted infection that affects the genital areas, with some strains causing genital warts and others leading to cancer.

Infectious

Capable of being transmitted from one person to another through various means, including direct or indirect contact, often leading to disease.

New STIs

New STIs refer to sexually transmitted infections that have recently been identified or have become more prevalent or recognized in populations.

Notifiable Disease

A disease that, by law, must be reported to government authorities upon diagnosis, primarily to monitor and control the spread of infectious diseases.

Q20: You purchased 300 shares of Deltona, Inc.

Q50: The investment timing decision relates to:<br>A) How

Q77: Calculate the standard deviation of an investment

Q116: Opportunity costs are considered cash flows of

Q214: Provide a definition for systematic risk principle.

Q241: Capital intensive projects have a high degree

Q286: A decrease in the corporate tax rate

Q298: The hypothesis that market prices reflect all

Q320: The higher the degree of operating leverage,

Q344: A project will produce an operating cash