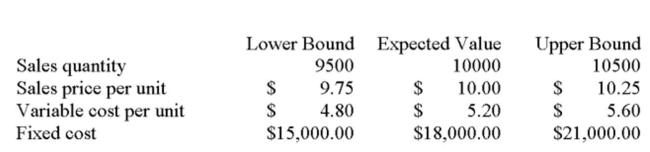

Magellen Industries is analyzing a new project. The data they have gathered to date is as follows:  Initial requirement for equipment: $120,000 Depreciation: Straight-line to zero over the four-year life of the project with no salvage value.

Initial requirement for equipment: $120,000 Depreciation: Straight-line to zero over the four-year life of the project with no salvage value.

Required rate of return: 15%

Marginal tax rate: 35%

What is the net present value under the best-case scenario?

Definitions:

Operating Leverage

A measure of how revenue growth translates into growth in operating income, indicating the proportion of fixed versus variable costs a company has.

ROCE

Return on Capital Employed (ROCE) is a financial ratio that measures a company's profitability in terms of the capital it uses.

ROE

Return on Equity; a measure of financial performance calculated by dividing net income by shareholders' equity, indicating how much profit a company generates with the money shareholders have invested.

Debt

Debt represents money borrowed by one party from another, under the condition that it is to be paid back with interest, typically used for business operations or purchases.

Q9: For a new project, a company plans

Q42: The tax-shield approach for calculating project operating

Q78: To fully understand the effects of a

Q123: The Franklin Co. is analyzing a proposed

Q144: Asemi-strong form efficiency of market efficiency is

Q171: The quantity sold at the accounting break-even

Q231: Jenna's Home Spa Sales currently sells 2,000

Q247: Katie's Cafe is considering the addition of

Q307: A four-year project requires an initial investment

Q393: Which one of the following occurs at