A project requires an initial investment of $10,000, straight-line depreciable to zero over four years. The discount rate is 10%. Your tax bracket is 34% and you receive a tax credit for negative earnings

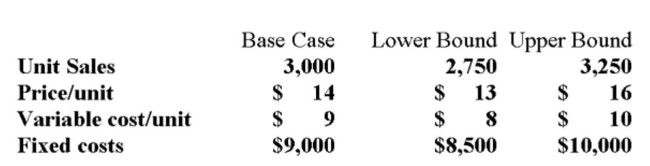

In the year in which the loss occurs. Additional information for variables with forecast error are

Shown below.  What is the worst case NPV for the project?

What is the worst case NPV for the project?

Definitions:

Dukes of Burgundy

Titles held by the rulers of the Burgundian State, spanning parts of modern-day France, Belgium, and the Netherlands from the 9th to the 15th centuries.

Flanders

A historical region in Northern Europe that today spans parts of Belgium, France, and the Netherlands, known for its role in the medieval and early modern textile trade and art.

Decentralization

The process of distributing or dispersing functions, powers, people, or things away from a central location or authority.

Religious Practice

The act of engaging in rituals, ceremonies, and worship as expressions of belief within a particular faith tradition.

Q27: The Wolf's Den Outdoor Gear is considering

Q36: TreeTop Ltd. currently sells $189,000 of trees,

Q45: What is the financial break-even point? Price

Q159: Provide a definition for the term forecasting

Q192: A firm is considering a project that

Q288: Calculate the standard deviation of an investment

Q336: The contribution margin is defined as the

Q338: Economic theory suggests that _ the likelihood

Q375: Magellen Industries is analyzing a new project.

Q424: What is the benefit of scenario analysis