A project requires an initial investment of $10,000, straight-line depreciable to zero over four years. The discount rate is 10%. Your tax bracket is 34% and you receive a tax credit for negative earnings

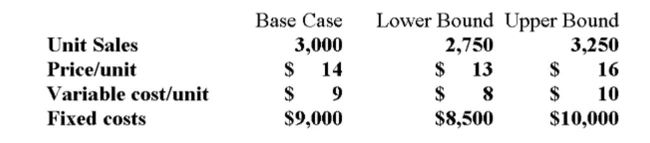

In the year in which the loss occurs. Additional information for variables with forecast error are

Shown below.  What is the base case NPV for the project?

What is the base case NPV for the project?

Definitions:

Securities

Financial instruments that represent ownership positions in corporations (stocks), creditor relationships with governmental bodies or corporations (bonds), or rights to ownership as represented by an option.

Forms

Documents with a prescribed format used for processing information relevant to business transactions, applications, surveys, or registrations.

Small Reporting Company

A designation by the SEC for smaller public companies that allows them to comply with less stringent financial reporting and disclosure requirements.

Annual Revenues

The total income generated by a business from its operations over a fiscal year before any expenses are subtracted.

Q101: With a mean of 5% and a

Q102: The frequency distribution of large-company stocks since

Q106: Provide a definition for the term operating

Q109: A project has the following estimated data:

Q113: Use the following historical average returns and

Q115: A stock has an expected rate of

Q195: A project with a high degree of

Q215: The operating cash flow of a project

Q254: On the basis of historical data from

Q264: Over the past 50 years, which of