Magellen Industries is analyzing a new project. The data they have gathered to date is as follows:  Initial requirement for equipment: $120,000 Depreciation: Straight-line to zero over the four-year life of the project with no salvage value.

Initial requirement for equipment: $120,000 Depreciation: Straight-line to zero over the four-year life of the project with no salvage value.

Required rate of return: 15%

Marginal tax rate: 35%

The project is operating at the ________ under the base-case scenario.

Definitions:

Secured Bonds

Bonds that are backed by specific assets of the issuer as collateral, giving bondholders a claim to those assets if the issuer defaults.

General Credit

An overarching term that may refer to the creditworthiness of an individual or entity, or sometimes used to describe general lines of credit available for borrowing.

Corporation

A legal entity that is separate and distinct from its owners, who are shareholders, providing limited liability protection among other benefits.

Sold

A term used when a product or service has been exchanged for payment or other consideration.

Q50: The pro forma statement of comprehensive income

Q64: Which one of the following most likely

Q77: Fixed costs are generally affected by the

Q95: A stock has an expected rate of

Q148: Fixed costs are equal to zero when

Q181: In general, would the degree of forecasting

Q204: Which one of the following is a

Q276: You are considering investing in a piece

Q317: The capital gains yield on a security:<br>A)

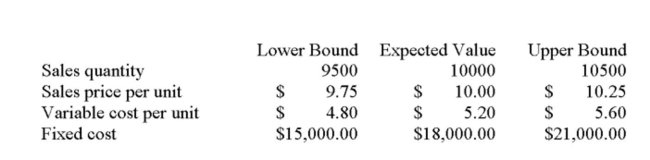

Q319: TD, Inc. is analyzing a new project.