A project requires an initial fixed asset investment of $600,000, which will be depreciated straight- line to zero over the six-year life of the project. The pre-tax salvage value of the fixed assets at the

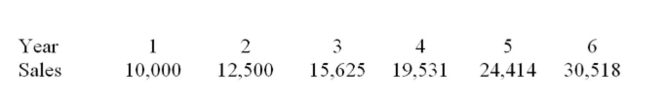

End of the project is estimated to be $50,001. Projected sales volume for each year of the project is

Shown below. The sale price is $50 per unit for the first three years, and $45 per unit for years 4

Through 1. A $30,000 initial investment in net working capital is required, with additional

Investments equal to 7.5% of annual sales for each year of the project. Variable costs are $35 per

Unit, and fixed costs are $50,000 per year. The firm has a tax rate of 34% and a required return on

Investment of 12%.  What is the NPV of the project?

What is the NPV of the project?

Definitions:

Independent Variable

The variable in an experimental or research setting that is manipulated to observe its effect on a dependent variable.

Religious Environments

Environments or settings where practices, beliefs, and values of a specific religion are predominant, influencing the behavior and mindset of individuals within.

Primary Hypothesis

The initial theory or proposition that a research study aims to test, often focused on a specific predicted outcome.

Null Hypothesis

A statement in hypothesis testing that assumes no significant difference or effect, serving as the default assumption to be tested against an alternate hypothesis.

Q17: When a firm has wages earned but

Q28: Kierofree Air Tours has the following payroll

Q84: Which of the following is considered a

Q97: A project has the following estimated data:

Q103: A project with IRR = _ just

Q143: Which one of the following is a

Q148: Yorktown Ltd. currently produces boat sails and

Q251: Which of the following is the best

Q256: The corporate officer generally responsible for tasks

Q341: An increase in accounts receivable is an