A project requires an initial fixed asset investment of $600,000, which will be depreciated straight- line to zero over the six-year life of the project. The pre-tax salvage value of the fixed assets at the

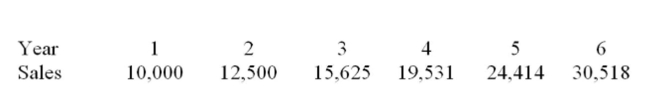

End of the project is estimated to be $50,001. Projected sales volume for each year of the project is

Shown below. The sale price is $50 per unit for the first three years, and $45 per unit for years 4

Through 1. A $30,000 initial investment in net working capital is required, with additional

Investments equal to 7.5% of annual sales for each year of the project. Variable costs are $35 per

Unit, and fixed costs are $50,000 per year. The firm has a tax rate of 34% and a required return on

Investment of 12%.  What are the additions to NWC during year 4 of the project?

What are the additions to NWC during year 4 of the project?

Definitions:

Specific Tests

Assessments designed to measure particular skills or knowledge in a targeted domain, used in various contexts such as education and employment screening.

Problem Seeker

An individual or entity that actively looks for potential issues or obstacles within a process or system with the aim of solving them proactively.

Anticipates

The act of expecting or predicting something in advance, allowing for preparedness and strategical planning.

Retail Chain

A network of stores owned by the same company, offering a variety of products or services across multiple locations.

Q10: Suppose you own 100 shares of IBM

Q25: You are evaluating a project for The

Q32: The Corporate Treasurer is in charge of:<br>A)

Q43: Consider the following statement by a business

Q67: Which one of the following actions by

Q164: What is the difference between third and

Q206: Explain how ethics can affect the value

Q207: When owners are managers (such as in

Q349: A pro forma financial statement is one

Q351: Which of the following statements regarding operating