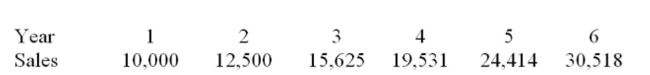

A project requires an initial fixed asset investment of $600,000, which will be depreciated straight- line to zero over the six-year life of the project. The pre-tax salvage value of the fixed assets at the

End of the project is estimated to be $50,001. Projected sales volume for each year of the project is

Shown below. The sale price is $50 per unit for the first three years, and $45 per unit for years 4

Through 1. A $30,000 initial investment in net working capital is required, with additional

Investments equal to 7.5% of annual sales for each year of the project. Variable costs are $35 per

Unit, and fixed costs are $50,000 per year. The firm has a tax rate of 34% and a required return on

Investment of 12%.  What is the operating cash flow during year 5 of the project?

What is the operating cash flow during year 5 of the project?

Definitions:

Institutionalized Ableism

Systemic preferencing of non-disabled individuals, resulting in discrimination against people with disabilities in various societal institutions.

Obesity Epidemic

Refers to the widespread and increasing occurrence of obesity within a population, considered a significant public health concern.

High-income Countries

Nations with a high gross national income per capita, which typically have well-developed industrial sectors and offer their citizens high standards of living.

Feminist Approach

A method of analysis and action focusing on women's issues and rights, aiming to address and reduce inequalities based on gender through social, cultural, political, and economic means.

Q1: Which of the following best describe the

Q18: Which one of the following statements is

Q27: The Wolf's Den Outdoor Gear is considering

Q93: Which one of the following is an

Q131: Webster United is considering adding a new

Q157: Margarite's Enterprises is considering a new project.

Q209: A coworker is in charge of a

Q260: What is the base case financial break-even

Q368: Variable costs change with the quantity of

Q379: A project that just breaks even on