A project requires an initial fixed asset investment of $600,000, which will be depreciated straight- line to zero over the six-year life of the project. The pre-tax salvage value of the fixed assets at the

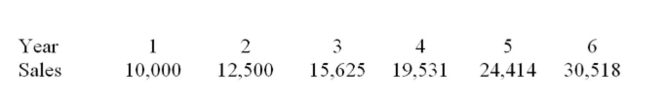

End of the project is estimated to be $50,001. Projected sales volume for each year of the project is

Shown below. The sale price is $50 per unit for the first three years, and $45 per unit for years 4

Through 1. A $30,000 initial investment in net working capital is required, with additional

Investments equal to 7.5% of annual sales for each year of the project. Variable costs are $35 per

Unit, and fixed costs are $50,000 per year. The firm has a tax rate of 34% and a required return on

Investment of 12%.  What is the NPV of the project?

What is the NPV of the project?

Definitions:

Specific Cultures

Cultural groups defined by detailed and particular attributes, values, and behaviors distinct to them.

Learning Organisation

Continuously changes and improves using the lessons of experience.

Continuous Adaptation

The ongoing process of making adjustments and changes to respond to the environment or circumstances effectively.

Innovation

The introduction of new ideas, products, services, or processes that add value or improve upon existing norms.

Q48: Payroll accruals reflect the amount of payroll

Q88: Which of the following statements concerning dealers

Q130: Which one of the following statements is

Q152: Which of the following best describe the

Q228: An increase in taxes is an example

Q286: A decrease in the corporate tax rate

Q305: The Alfonso Company is analyzing a project

Q313: As additional equipment is purchased, the level

Q344: A project will produce an operating cash

Q351: Which of the following statements regarding operating