A project requires an initial fixed asset investment of $600,000, which will be depreciated straight- line to zero over the six-year life of the project. The pre-tax salvage value of the fixed assets at the

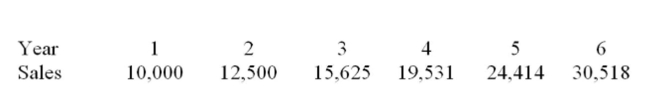

End of the project is estimated to be $50,001. Projected sales volume for each year of the project is

Shown below. The sale price is $50 per unit for the first three years, and $45 per unit for years 4

Through 1. A $30,000 initial investment in net working capital is required, with additional

Investments equal to 7.5% of annual sales for each year of the project. Variable costs are $35 per

Unit, and fixed costs are $50,000 per year. The firm has a tax rate of 34% and a required return on

Investment of 12%.  What are the additions to NWC during year 4 of the project?

What are the additions to NWC during year 4 of the project?

Definitions:

Change Outcomes

The results or effects that occur as a consequence of implementing change within an organization.

Better Outcomes

refers to improved results or benefits achieved through particular actions or decisions.

Efforts

The physical or mental energy exerted towards achieving goals, tasks, or overcoming challenges.

Performance

The act of carrying out a task or function, often measured against known standards of accuracy, completeness, and speed.

Q27: Employers benefit by offering POPs because they

Q32: Which of these accounts is increased by

Q40: What does the term "billable time" mean

Q58: What is true about the trial balance?<br>A)

Q68: Salaried employees may be classified as nonexempt.

Q208: Which of the following statements regarding cash

Q258: Using the tax shield approach, calculate OCF

Q268: Provide a definition for the term fixed

Q286: A decrease in the corporate tax rate

Q355: The cash flow from projects for a