Use the information below to answer the following question.

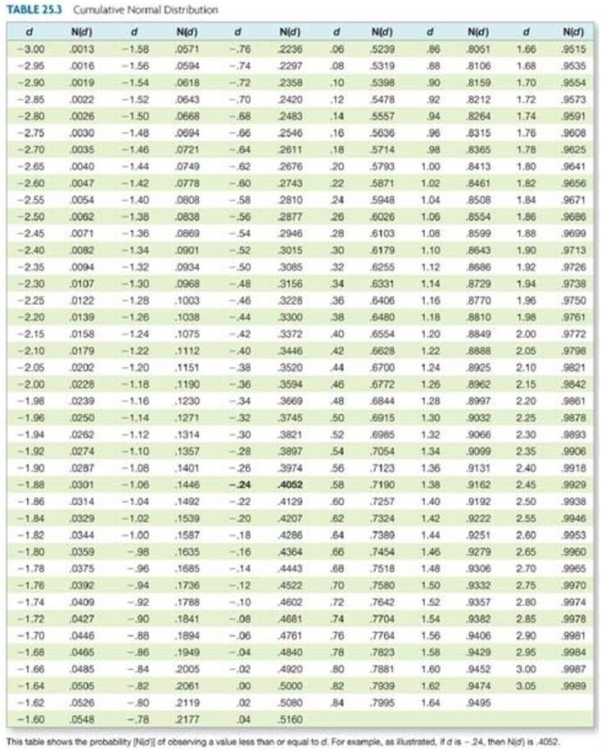

Upside Down has a zero coupon bond issue outstanding with a $10,000 face value that matures in one year. The current market value of the firm's assets is $12,400 while the standard deviation of the returns on those assets is 22 percent annually. The annual risk-free rate is 4.6 percent, compounded continuously. What is the market value of the firm's debt based on the Black-Scholes model?

Definitions:

Elasticity

A measure in economics of how the quantity demanded or supplied of a good changes in response to price or other factors.

Upper-left Portion

Typically refers to the area in the upper left of a graph or chart, which can represent a specific range of values or conditions in graphical analyses.

Original Price

The initial price set for a product or service before any discounts, rebates, or promotions are applied.

Price Elasticity

An assessment of the degree to which the demand or supply for a product varies following a price alteration.

Q3: The absolute threshold is the intensity difference

Q6: Which one of these statements related to

Q9: Firms A and B formally agree to

Q12: Global Inc. just placed an order for

Q23: Which of the following is a nonmarketing

Q28: Which one of the following inventory items

Q28: _ is the process of determining the

Q29: Suppose the spot exchange rate is C$1.273

Q45: Assume you just returned from some extensive

Q75: A $20 put option on Wildwood stock