Use the information below to answer the following question.

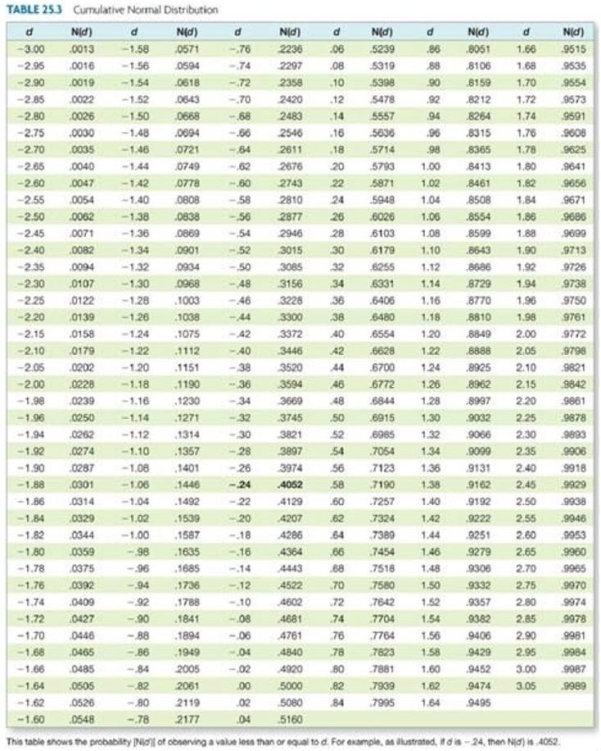

Alpha is considering a purely financial merger with Beta. Alpha currently has a market value of $14 million, an asset return standard deviation of 55 percent, and pure discount debt of $6 million that matures in four years. Beta has a market value of $6 million, an asset return standard deviation of 60 percent, and pure discount debt of $2 million that matures in four years. The risk free rate, continuously compounded, is 3.5 percent. The combined equity value of the two separate firms is $14,180,806. By what amount will the combined equity value change if the merger occurs and the asset return standard deviation of the merged firm is 45 percent?

Definitions:

Standardized Tests

Tests that are administered and scored in a consistent manner, used to assess the performance of individuals relative to a standard or to each other.

Math Ability

refers to the skills and competencies in understanding, analyzing, and applying mathematical concepts and procedures.

Negative Effects

Negative effects are undesirable or harmful outcomes resulting from specific actions, conditions, or circumstances.

Supposed Emotionality

The assumption that certain individuals or groups are inherently more emotional or driven by emotions, often used in gender stereotyping.

Q1: Which one of the following will be

Q20: In a direct lease, the:<br>A) lessor is

Q20: Explain the process of perceptual organization.

Q21: Brentwood Industries is selling its tool and

Q35: Assume you are an overconfident manager. You

Q35: Which one of the following is true

Q49: Rosa purchased three call option contracts on

Q50: Which of the following statements is true

Q59: Assume a stock price of $21.80, an

Q64: Dog's can borrow money at either a