Use the information below to answer the following question.

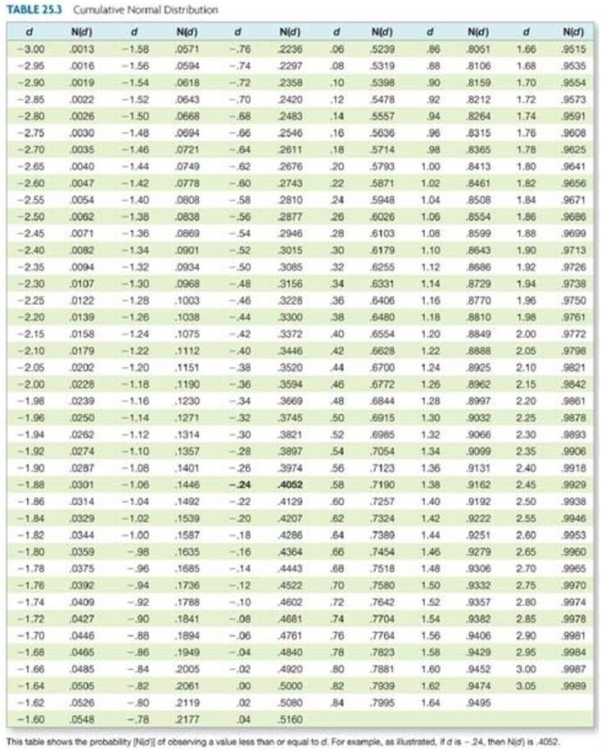

Upside Down has a zero coupon bond issue outstanding with a $10,000 face value that matures in one year. The current market value of the firm's assets is $12,400 while the standard deviation of the returns on those assets is 22 percent annually. The annual risk-free rate is 4.6 percent, compounded continuously. What is the market value of the firm's debt based on the Black-Scholes model?

Definitions:

Common Stock

Common stock represents ownership interests in a corporation, giving shareholders voting rights and a share in the company’s profits through dividends.

Common Stock

A form of corporate equity ownership, a type of security that represents ownership in a corporation and a claim on part of its profits.

Journal Entry

A recording in the accounting ledger that notes all the financial transactions of a business.

Prepaid Insurance

An asset account that reflects the amount paid for insurance policies in advance, before the coverage period begins.

Q4: Amy is a current shareholder of DJ

Q4: Marketing stimuli can be made pleasant by

Q8: Over the past six months, you have

Q16: A new customer has placed an order

Q26: Which of the following is a difference

Q33: Assume a stock price of $31.18, risk-free

Q46: Explain consumer behavior as a dynamic process.

Q50: Assume the risk-free rate increases by one

Q56: Electronic Importers has a pure discount bond

Q74: When evaluating an acquisition you should:<br>A) concentrate