Use the information below to answer the following question.

Alpha is considering a purely financial merger with Beta. Alpha currently has a market value of $14 million, an asset return standard deviation of 55 percent, and pure discount debt of $6 million that matures in four years. Beta has a market value of $6 million, an asset return standard deviation of 60 percent, and pure discount debt of $2 million that matures in four years. The risk free rate, continuously compounded, is 3.5 percent. The combined equity value of the two separate firms is $14,180,806. By what amount will the combined equity value change if the merger occurs and the asset return standard deviation of the merged firm is 45 percent?

Definitions:

Moral Philosophies

The study of questions about right and wrong, virtue and vice, and the conduct and character of human beings.

Ethical Issues

Moral challenges or dilemmas arising in professional or social contexts, requiring individuals to choose between actions based on moral principles.

Obama's Administration

The presidency of Barack Obama, spanning from 2009 to 2017, marked by significant policy changes in healthcare, environmental protection, and economic recovery.

Ethical Employees

Individuals who conduct themselves in the workplace according to moral principles, making decisions that reflect integrity and responsibility.

Q1: Jenny skips breakfast to attend an important

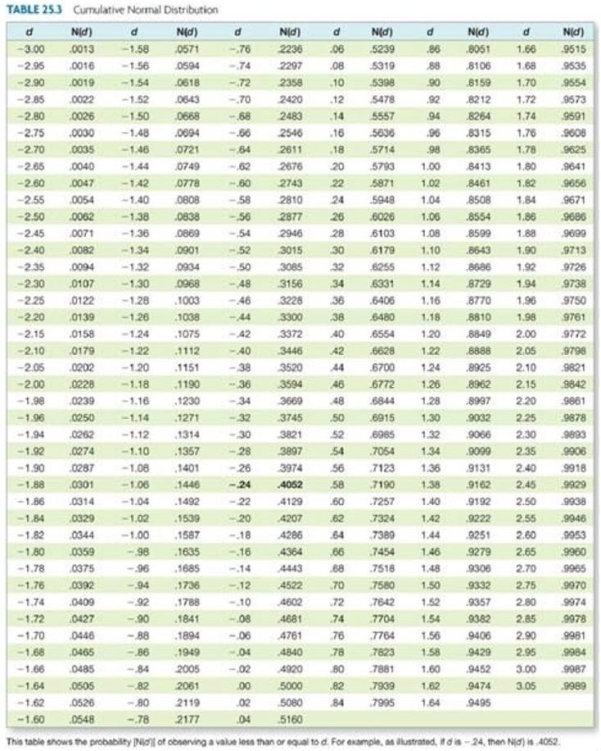

Q4: In the Black-Scholes option pricing formula, N(d₁)

Q10: Parkway Express needs $172,540 a week to

Q22: You are considering a project that has

Q44: Which one of the following is a

Q45: Working memory is where most of the

Q57: Futures contracts on gold are based on

Q70: Which one of the following credit instruments

Q72: Which one of the following supports the

Q85: The condition stating that the interest rate