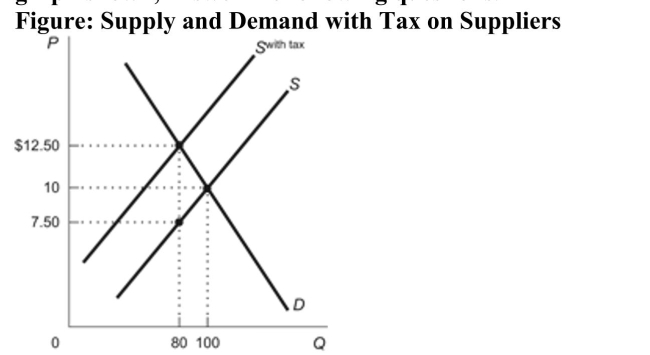

(Figure: Supply and Demand with Tax on Suppliers) Using the graph shown, answer the following questions.  a. What was the equilibrium price in this market before the tax? b. What is the amount of the tax? c. How much of the tax will the buyers pay? d. How much of the tax will the sellers pay? e. How much will the buyer pay for the product after the tax is imposed? f. How much will the seller receive after the tax is imposed? g. As a result of the tax, what has happened to the level of market activity?

a. What was the equilibrium price in this market before the tax? b. What is the amount of the tax? c. How much of the tax will the buyers pay? d. How much of the tax will the sellers pay? e. How much will the buyer pay for the product after the tax is imposed? f. How much will the seller receive after the tax is imposed? g. As a result of the tax, what has happened to the level of market activity?

Definitions:

Smallest Observation

The lowest value recorded in a data set.

1st Quartile

The value below which 25% of the data points in a dataset fall, indicating the lower quarter of the data.

3rd Quartile

Also known as the upper quartile, it is the value below which 75% of the data in a dataset falls.

Symmetric Distribution

A distribution where the left and right sides of the distribution are mirror images of each other.

Q13: Protectionism protects domestic industries from the competitive

Q39: Explain the change in tactics Gary Becker

Q54: (Figure: Tax on Consumers of Gadgets) According

Q55: Explain the difference between the nominal exchange

Q76: Newly formed trade unions raise wages for

Q80: A price ceiling is a legal maximum

Q84: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3375/.jpg" alt=" A) X; Y

Q98: Whether a buyer or a seller pays

Q113: Which of the following statements is TRUE?

Q116: Explain why price controls may actually end