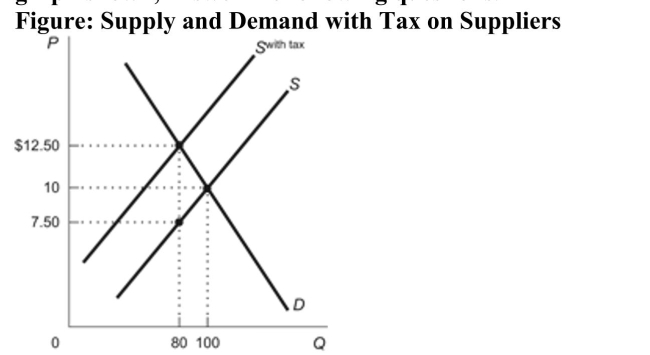

(Figure: Supply and Demand with Tax on Suppliers) Using the graph shown, answer the following questions.  a. What was the equilibrium price in this market before the tax? b. What is the amount of the tax? c. How much of the tax will the buyers pay? d. How much of the tax will the sellers pay? e. How much will the buyer pay for the product after the tax is imposed? f. How much will the seller receive after the tax is imposed? g. As a result of the tax, what has happened to the level of market activity?

a. What was the equilibrium price in this market before the tax? b. What is the amount of the tax? c. How much of the tax will the buyers pay? d. How much of the tax will the sellers pay? e. How much will the buyer pay for the product after the tax is imposed? f. How much will the seller receive after the tax is imposed? g. As a result of the tax, what has happened to the level of market activity?

Definitions:

Compliments

Expressions of praise, admiration, or congratulation towards someone.

Receptionist

An administrative professional responsible for welcoming visitors, managing phone calls, and handling inquiries at the front desk of a business or organization.

Hiatal Hernia

A medical condition where part of the stomach protrudes through the diaphragm into the chest cavity.

Continuous Positive Airway Pressure

A treatment method for sleep apnea that uses mild air pressure to keep the airways open.

Q27: Which of the following refers to the

Q31: In a typical year, changes in government

Q68: In the short run, a tighter monetary

Q69: (Figure: Commodity Tax) Use the figure to

Q75: A tax on sellers of apples:<br>A) leads

Q78: Economic growth requires:<br>A) job destruction.<br>B) trade barriers.<br>C)

Q93: In a free market, there are no

Q114: Which of the following would be the

Q117: When the prices of necessities such as

Q137: If price controls are so harmful, why